top of page

All Posts

Importance of Digital Signature Services in India

In today’s digital-first environment, physical paperwork has rapidly become a thing of the past. Whether you're filing statutory returns,...

Bhagya Lakshmi

Jul 93 min read

🧾 Section 14A and Rule 8D: Can You Disallow What Was Never Claimed?

💡 "You can’t disallow what was never claimed. No exempt income, no disallowance — simple as that." 📘 Introduction Section 14A of the...

Bhagya Lakshmi

Jul 83 min read

Comprehensive Business Consultation Services in India

In the ever-changing world of business, staying competitive and overcoming daily challenges can feel overwhelming—especially for small...

Bhagya Lakshmi

Jul 33 min read

Effective Financial Risk Management for Indian Businesses

In today’s fast-moving business world, managing financial risks isn’t a luxury—it’s a must. Whether you’re running a startup or an...

Bhagya Lakshmi

Jul 23 min read

🧾 Black to White No More: ITAT's Crackdown on Farmland Flipping

For decades, a widely used trick to convert black money into white was deceptively simple: buy farmland using cash and undervalued...

Bhagya Lakshmi

Jun 302 min read

Understanding Categories of Income in India

Income is a vital aspect of everyone’s life, influencing lifestyle, savings, and investments. In India, understanding different income...

Bhagya Lakshmi

Jun 304 min read

Top Income Tax Exemptions

If you're a salaried employee , you have access to several powerful tax exemptions and deductions that can help reduce your taxable...

Bhagya Lakshmi

Jun 263 min read

Understanding Income Tax in India: A Simple Guide for Every Citizen

Understanding income tax is crucial for every citizen in India. It’s a direct tax levied by the government on income earned by...

Bhagya Lakshmi

Jun 253 min read

💼 Hindu Undivided Family (HUF): A Timeless Tax-Saving Tool

🔍 What is an HUF? A Hindu Undivided Family (HUF) is a unique feature of Indian law that allows a family consisting of all persons...

Bhagya Lakshmi

Jun 255 min read

🏡 Section 54F: Multiple Houses, Oral Gifts & the Path to Exemption

Section 54F of the Income Tax Act, 1961 offers capital gains exemption when the gains from a long-term capital asset (other than a...

Bhagya Lakshmi

Jun 243 min read

🧾 Section 79(1)(c) of CGST Act: Garnishee Notices – A Tool or a Trap?

The GST regime empowers tax authorities with sweeping recovery powers, especially when tax remains unpaid. Among these, Section 79(1)(c)...

Bhagya Lakshmi

Jun 184 min read

🏛️ Decoding the Bombay Dyeing GST Case: Implications for Businesses 🛡️

A recent case providing interim relief in GST matters is that of The Bombay Dyeing & Manufacturing Company Ltd. vs. State of Maharashtra...

Bhagya Lakshmi

Jun 123 min read

🛡️ When Suppliers Default: How Courts Are Safeguarding Your Rightful ITC

In the intricate maze of GST compliance, one recurring challenge faced by honest businesses is the denial of Input Tax Credit (ITC) due...

Bhagya Lakshmi

Jun 103 min read

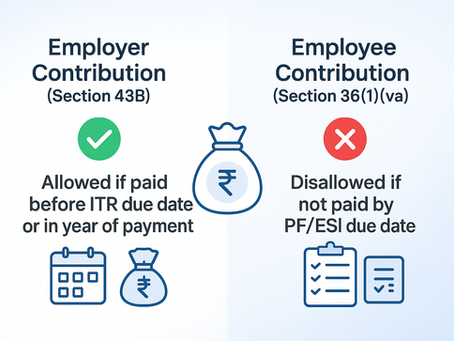

🧾 Employee vs Employer Contributions to PF/ESI: Disallowed or Allowed? What Does Courts say

In the world of tax compliance, one of the most frequently litigated topics is the allowability of PF/ESI contributions — especially...

Bhagya Lakshmi

Jun 53 min read

📝 TDS Not Deducted? You Might Still Save the Deduction – Section 40(a)(ia) Case Law Guide with Focus on Form 26A

📌 Introduction In tax audits, one of the most common disallowances is under Section 40(a)(ia) —for non-deduction or non-payment of TDS ....

Bhagya Lakshmi

Jun 23 min read

⚖️ Landmark Case Laws on TDS for Cash Withdrawal – Section 194N in Action

The Indian government’s thrust toward a digital economy took a sharp turn in 2019 with the introduction of Section 194N of the Income Tax...

Bhagya Lakshmi

May 303 min read

💸 Section 40A(3) of the Income Tax Act: Disallowance of Cash Payments – And the Lifeline Rule 6DD

In today’s digital economy, the government has put a strong emphasis on curbing cash transactions. One of the key sections enforcing this...

Bhagya Lakshmi

May 283 min read

🧾 Section 69C of Income Tax Act: Understanding Unexplained Expenditure through Key Case Laws

Section 69C empowers tax authorities to deem unexplained expenditure as income if the assessee fails to offer a satisfactory...

Bhagya Lakshmi

May 273 min read

Unexplained Bank Deposits, AIS Alerts & Section 69: What the Courts Really Say

✍️ Introduction With the Annual Information Statement (AIS) now tracking every high-value cash deposit , many taxpayers are receiving...

Bhagya Lakshmi

May 264 min read

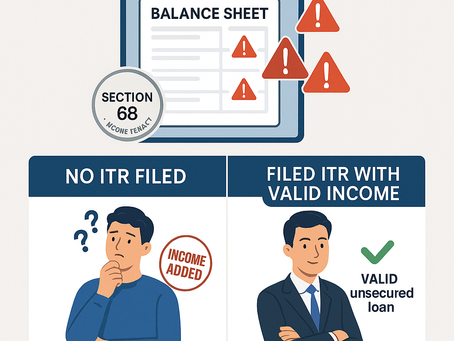

💼 Unsecured Loans and Income Additions – A Deep Dive into Section 68 of the Income Tax Act

📜 Introduction Section 68 of the Income Tax Act, 1961, empowers the Assessing Officer (AO) to treat any unexplained cash credit in the...

Bhagya Lakshmi

May 223 min read

bottom of page